We do so by recording Thank You for Closed Business (TYFCB). The TYFCB programme is used to appreciate and acknowledge those members who GIVE business-generating, qualified referrals.

Why do we record TYFCB?

- Accountability – It shows who is working for others in the group by making referrals that turn into business.

- Visibility – It shows visitors that BNI generates business.

- Credibility – It gives you credibility with the member you are thanking.

- Revenue Received or Return on Investment (ROI) – If you record your TYFCB through the BNI Connect Mobile App, it also shows how much money you are making from your BNI membership.

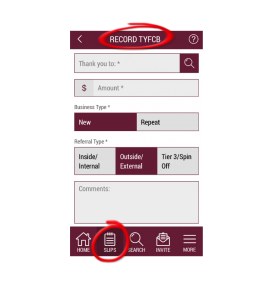

How do we record TYFCB?

The ideal way to record our TYFCB at BNI is through the BNI Connect Mobile App.

Why should we use the BNI Connect Mobile App?

- It’s confidential

- It’s fast

- It reduces work for the VP

- It shows you your return on your investment in BNI

- You can thank across/between chapters

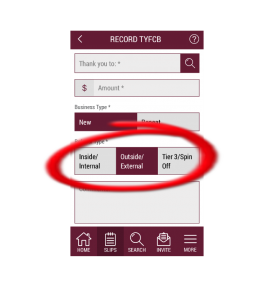

What TYFCB should we record?

- Inside/Internal – between BNI members

- Outside/External – between a member and another member external contact

- Tier 3/Spinoff – business from a previously referred external contact

Additional discussion points about TYFCB:

- The update to the overall statistics on member home screens/dash boards and the chapter statistic reports won’t happen until each PALMS report is submitted by the chapter Vice President.

- We can record TYFCB from a visitor or ex member but not business we have given to ex-members.

- It’s BNI policy that we shouldn’t announce TYFCB during the referrals and testimonials section of our BNI meeting, especially in lieu of a referral or testimonial.

- TYFCB is confidential to the member recording the information, no client names are recorded and the member being thanked can’t see which member is thanking them.

How much TYFCB should we record?

In general, we record the dollar amount, excluding GST your business has received from a customer as a result of a referral from a BNI Member.EXAMPLES:

- A website designer builds a new website for $1,500 plus GST. This would be recorded as $1,500 TYFCB.

- A HVAC technician provides a $500 air filter plus they charge a $100 installation fee. This would be reported as $600 TYFCB.

- A real estate agent sells a home for $600,000 with a 4% real estate fee. This would be entered as $24,000 TYFCB (we enter the total commission amount paid by the customer to the real estate agent’s company).

- A travel agent books a $5,000 trip to Fiji. The full $5,000 paid by the customer to the travel firm is recorded as TYFCB.

- A fire and general insurance broker sells a $800 plus GST car insurance policy. Record this as $800 TYFCB.

- A life insurance broker signs up a new client. We record the total commission that will be due for the average life of the policy type immediately.

- Banks should also record the interest for the entire loan immediately. For lines of credit (e.g. credit cards or home equity loans) report 10% of the line amount.

The key is to use common sense and the examples above when it comes to measuring results with consistency. A short way to remember the complex description above is that with some exceptions, we generally track the total revenue to the individual member and their respective company represented in BNI (the gross value of the invoice to the customer).

Challenge for the week:

Think about tier 3 TYFCB that you may not have recorded yet.

Make sure your TYFCB is up to date and reported regularly.

Further information is available:

BNI Podcast 289: https://www.bnipodcast.com/?s=289

BNI University: https://www.schoox.com/691238/reporting-overview-msp%E2%84%A2-part-12-of-16

BNI Podcast 552: https://www.bnipodcast.com/?s=552